Singapore's Prime Minister, Lawrence Wong. AFP.

Investment summary

Biggest single-day decline for the Straits Times Index (STI) since 2008. The Singapore market saw the largest single-day decline since 2008 when the STI plunged 7.5% on 7 Apr 2025 – in line with other equity markets as a reaction to higher trade tariffs and just a shade off the 2008 decline of 8.3%. With yesterday’s loss of 2.2%, or the eighth consecutive day of losses, the STI has shed a total of 14.8% in the last eight trading sessions. Selling was across the board as all sectors fell. Key index components also saw larger-than-average rates of decline. For the STI component stocks, several saw trading volumes in excess of 5-6x the average 6-month trading volume.

Is a full-blown global trade war happening? In the latest salvo, the US imposed 104% tariffs on Chinese imports and China retaliated with 84% duties on US goods, and this was then followed by US raising duties on China to 125%. Overnight, President Trump also announced a 90-day pause on higher tariffs that hit trading partners. Prior to this, Asian countries were some of the hardest hit from higher US tariffs with Cambodia at 49%, Laos at 48% and Vietnam at 46%. Singapore’s nearer neighbours are also subjected to higher tariffs with Thailand at 36%, Indonesia at 32%, Malaysia at 24% and Singapore at 10%.

Singapore imposes no tariffs on US products under the US-Singapore Free Trade Agreement (USSFTA). Singapore also imports more from the US than its exports to the US. The wider implication is highly dependent on whether these countries are prepared to meet and negotiate or opting for tit-for-tat reciprocal tariffs.

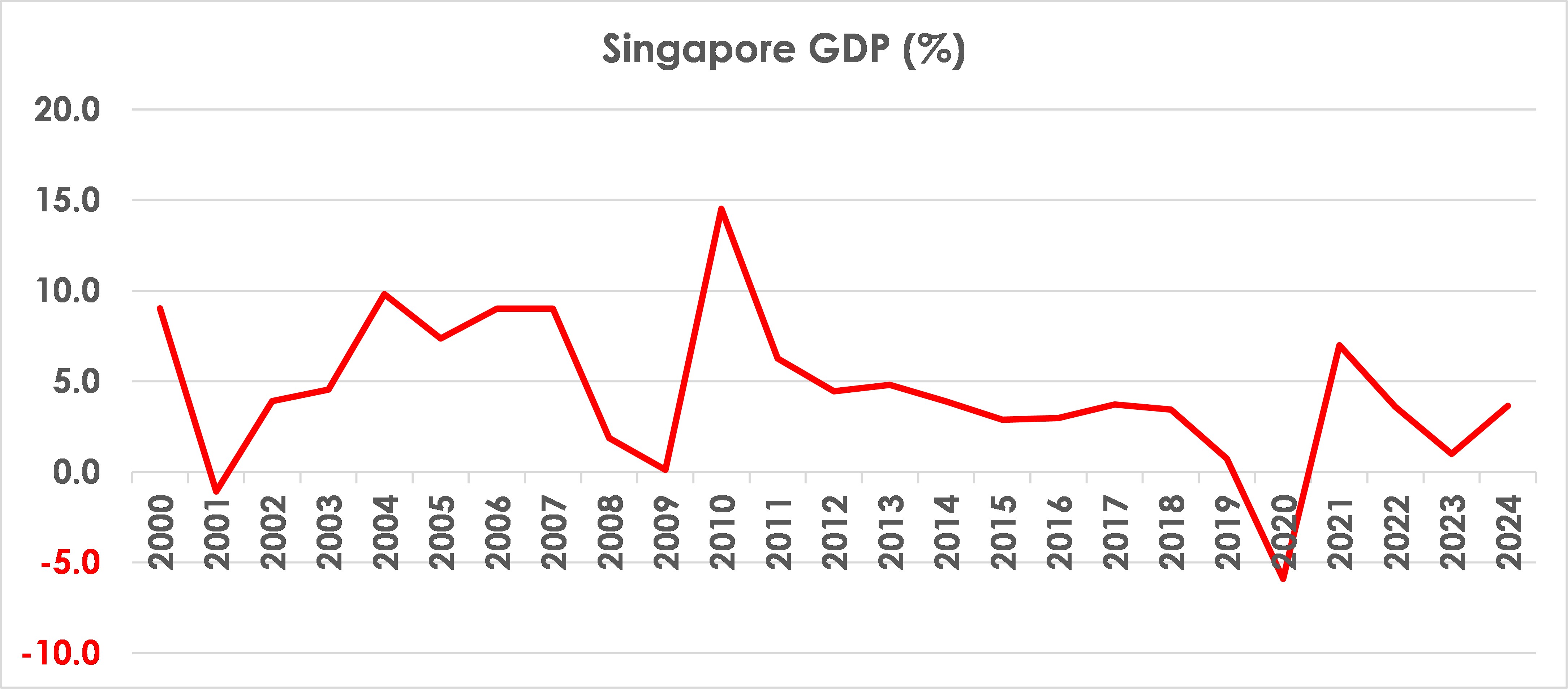

Recession cannot be ruled out. Singapore is deemed to be relatively less impacted when compared to other countries with a 10% tariff rate. However, as an open and small economy which is fairly dependent on exports, Singapore will not be spared from the tariffs storm hitting most Asian economies. Prime Minister Lawrence Wong recently spoke in Parliament on 8 April 2025 and mentioned that while Singapore may or may not enter into a recession this year, growth will be “significantly impacted” by tariffs. The government is also re-assessing the official GDP forecast of 1-3%, with the likelihood of lowering the growth projection. If this crisis is not resolved soon, slower economic growth for Singapore and its regional partners will mean weak demand for goods and services and will impact both consumers and companies. Further on, other wider impact could mean fewer jobs as companies re-locate or reduce headcount.

Source: Bloomberg and Ministry of Trade and Industry (MTI)

Higher tariffs = higher costs for consumers and businesses. As the trade tariffs situation is still evolving, this has created significant volatility for equity markets in the past few days. The global trade situation is looking even more murky and complex as it involves many key trading partners. With no impending major negotiations to defuse the situation, higher tariffs will result in significantly higher prices for consumers and businesses. It is currently difficult to assess the full longer term economic impact on most economies.

Based on current announced tariffs, this region is quite severely impacted by the new US tariffs, especially Vietnam, Cambodia, Thailand and Indonesia. This could result in more intense regional efforts to deal with this crisis. Malaysia is also leading the effort for a regional response to the tariffs. In this uncertain environment, and if the situation drags on throughout the year, it is likely to have a significant impact on the Singapore economy.

Most companies are likely to pass the higher costs on to consumers. As prices go higher and faced with a weaker outlook, consumers are likely to be more selective about their spendings, and this will impact consumer discretionary items and to a lesser extent consumer stable items. While a selected few basic items could be partially subsidised, most items are likely to become more expensive.

Opportunity in crisis. Increasingly, the risks of a major slowdown cannot be ignored. With sharply high trade tariffs, and if this trend persists, it will hurt economic and corporate growth. Singapore will also be impacted, although to a slightly lesser degree. Singapore’s STI earnings growth have fallen by double-digit rates on two occasions – once in 2009 after the Global Financial Crisis (GFC) and recently during the pandemic in 2020.

Based on past events, markets tend to recover within 1-2 years after a sharp correction. During the GFC, the STI recovered 70% within a year (from the low in Oct 2008) after losing 23.6% in the month of Oct 2008. Similarly, the STI fell 17.6% in March 2020, but recovered 22% within a year or 42% in two years. Short-term volatility is likely to remain, but fundamentals will provide some support over the longer term.

Singapore banks are pivotal. With the tit-for-tat retaliatory measures taking place globally, the situation could deteriorate further before it recovers. This means that markets are likely to remain volatile. In the Singapore market, the banking sector plays a pivotal role and accounts for almost 50% of the market capitalisation of the STI. The sharp price corrections have brought valuations to more attractive levels. Apart from attractive dividend yields, banking stocks will also find support from share buyback programmes. These measures will help to provide price support for Singapore banks, and this will in turn provide partial support to the STI.

Current price weakness looks like a situation of trying to catch a falling knife and it is challenging to see the bottom. While the global market situation is likely to stay volatile and will continue to have spillover effect on the Singapore market, it is also a good opportunity to re-look at quality stocks for better entry or re-entry levels. Singapore blue chips, with well-established track records, good dividend yields, P/Es of 12.0x and P/Bs of 1.1x offer less volatile value stocks which are better positioned to weather this trade storm.

Important information

This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.