OPEC Secretary-General Haitham al-Ghais. AFP.

We had expected OPEC+ to extend production cuts once again. But OPEC+ surprised markets as delegates from the eight members holding the 2.2-mb/d of voluntary cuts announced they would proceed as planned with the unwind starting on 1 April. It also announced that, to partially offset this, OPEC+ has also agreed with countries which have overproduced volumes (including Iraq and Kazakhstan) that they would front-load their compensatory cuts. However, the precise plans for this have not yet been made public.

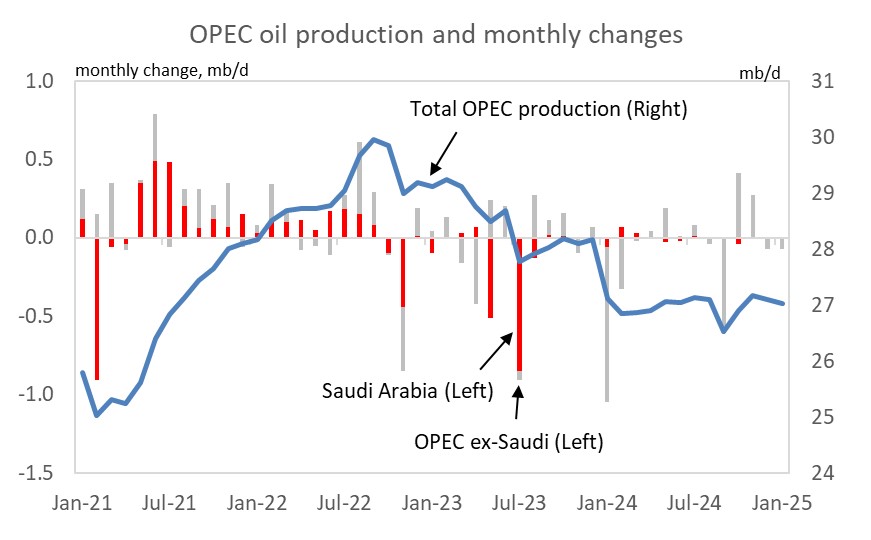

OPEC’s surprise move to proceed with planned production hikes adds to risk of lower oil prices

Source: Bloomberg, Bank of Singapore.

In our view, the OPEC+ announcement that it would start unwinding its voluntary cuts looks like a risky decision amid softer US sentiment data, tariff escalation and talk of easing sanctions on Russia. Oil markets have gone back to worrying about demand amid uncertainty fueled by tariff threats. The uncertainty around trade policy seems to have affected US business and household sentiment. A potential Russia-Ukraine ceasefire that paves way for sanctions relief on Russian energy also weighs on oil prices. But the failure of the US and Ukraine to sign a minerals deal increases the uncertainty regarding a potential ceasefire.

The unexpected OPEC+ move signalled a departure from the previous cautious approach that led the group to thrice delay the easing of its output cuts, which have now been in force for over two years. OPEC’s move poses downside risk to oil prices, absent other developments such as lower supply from Iran and Venezuela. Prospects of lower oil prices, however, would align with Trump’s push to lower energy prices.

The higher cost of producing oil from US shale compared to OPEC’s “low” cost is set to disincentivise US drilling given prospects of lower oil prices. As an example, survey data from the Dallas Fed shows that in the Permian Basin (the most productive basin in the US), the average new well needs WTI price to be around USD62-USD64 per barrel to breakeven. The Trump administration’s deregulatory policies are therefore unlikely to boost activity, but technology and efficiency gains will have more impact.

The OPEC+ statement left the door open to adjustments down the line depending on market conditions. It is possible that the unwind of voluntary cuts may not last the full extent. OPEC member states face rising breakeven levels for their oil, putting pressure on their fiscal budgets. The elevated budgetary needs of several OPEC members mean they will continue to favour maximising revenue by supporting oil prices.

Important information

This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.